Essential Tips for First-Time Insurance Buyers: Your Guide to Smart Choices

March 5, 2026 | 4 min read | Adan from Paca

Are you a first-time insurance buyer feeling overwhelmed by the options and jargon? Don’t worry; you’re not alone! Navigating the insurance world can be daunting, but with the right guidance, you can make informed decisions that suit your needs. In this post, we’ll provide you with essential tips to help you choose the right coverage and empower you to be confident in your choices. Understanding insurance doesn’t have to be complicated, and we’re here to make the process as smooth as possible for you.

Understanding Insurance Basics

Before diving into specific tips, it’s important to understand some fundamental insurance concepts. Insurance is a contract that provides financial protection against potential losses or damages. As a policyholder, you pay premiums to the insurer in exchange for this coverage. Different types of insurance serve various purposes, such as protecting your health, vehicle, home, or life. Familiarizing yourself with these basic concepts is the first step to making informed decisions.

Types of Insurance Coverage

There are several types of insurance coverage that you should be aware of. Health insurance covers medical expenses for illnesses, injuries, and preventive care. Auto insurance protects against financial loss in case of accidents or theft involving your vehicle. Homeowners or renters insurance provides coverage for your home or rental property and belongings. Life insurance offers financial support to beneficiaries after the policyholder’s death, ensuring their security.

Key Tips for First-Time Insurance Buyers

-

Assess Your Needs

Before purchasing insurance, take the time to evaluate your specific needs. Consider factors like your health, lifestyle, assets, and financial situation to determine the coverage that best suits you. Understanding what you need will help you choose the right type of coverage and avoid unnecessary expenses. By thoroughly assessing your needs, you can ensure you’re neither over-insured nor under-insured.

-

Research Different Options

Don’t settle for the first policy you come across; instead, explore different options. Compare various insurance providers and policies to find the best fit for your requirements and budget. Look for reviews and ratings to gauge the reliability and reputation of insurers. Researching different options will give you a broader perspective on what’s available in the market.

-

Understand the Terms

Insurance policies can be full of complex terms that may be confusing for first-time buyers. Make sure you understand the key components like premiums, deductibles, coverage limits, and exclusions. These terms define the scope of your policy and your financial obligations. If you’re unsure, don’t hesitate to ask for clarification from the insurer or an advisor.

-

Consider Your Budget

Determine how much you can comfortably afford to pay in premiums. While you want adequate coverage, it’s important not to overextend your finances. Look for policies that offer a balance between cost and coverage. This ensures you get the protection you need without straining your budget.

-

Seek Professional Advice

If you’re feeling lost, consider consulting with an insurance advisor. They can provide personalized assistance and help you navigate through the options available. An advisor can ensure you make informed decisions and choose policies that align with your needs. Professional guidance can be invaluable for first-time buyers.

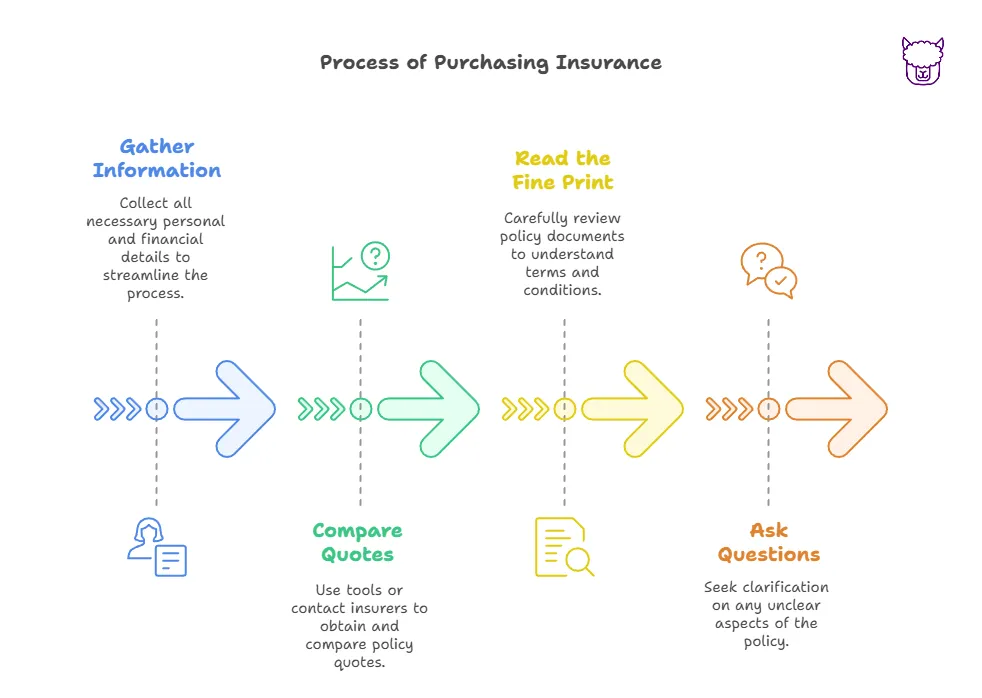

Practical Steps for Making Your First Purchase

-

Step 1: Gather Information Collect all necessary personal and financial information. This includes details about your assets, health history, and any existing coverage. Having this information ready will streamline the process. It ensures that you can provide accurate details to insurers.

-

Step 2: Compare Quotes Use online tools or contact insurers directly to get quotes for the policies you’re interested in. Comparing quotes will give you a sense of the market rates and help you find competitive pricing. This step is crucial to ensure you’re getting the best value. It allows you to make an informed choice.

-

Step 3: Read the Fine Print Before signing any contracts, carefully read through the policy documents. Pay attention to the terms and conditions to avoid any surprises later on. Understanding the fine print ensures you know exactly what you’re agreeing to. It’s an essential step in protecting your interests.

-

Step 4: Ask Questions Don’t hesitate to ask questions about anything you don’t understand. Knowledge is power, and the more you know, the better equipped you’ll be to make the right choice. Insurers should be willing to clarify any doubts you have. This transparency is key to a successful purchase.

Additional Resources

- Tips for Auto Insurance Buyers: Seven ways to save! Read Our Guide

Conclusion

Buying insurance for the first time can seem daunting, but with these tips, you’re well on your way to making smart, informed decisions. Remember, Paca Insurance is here to empower you with unbiased information and personalized assistance. Whether you need help understanding policy terms or comparing options, our team is ready to guide you every step of the way. Don’t hesitate to reach out if you have questions or need further assistance. Your insurance journey starts here, and we’re excited to support you along the way!