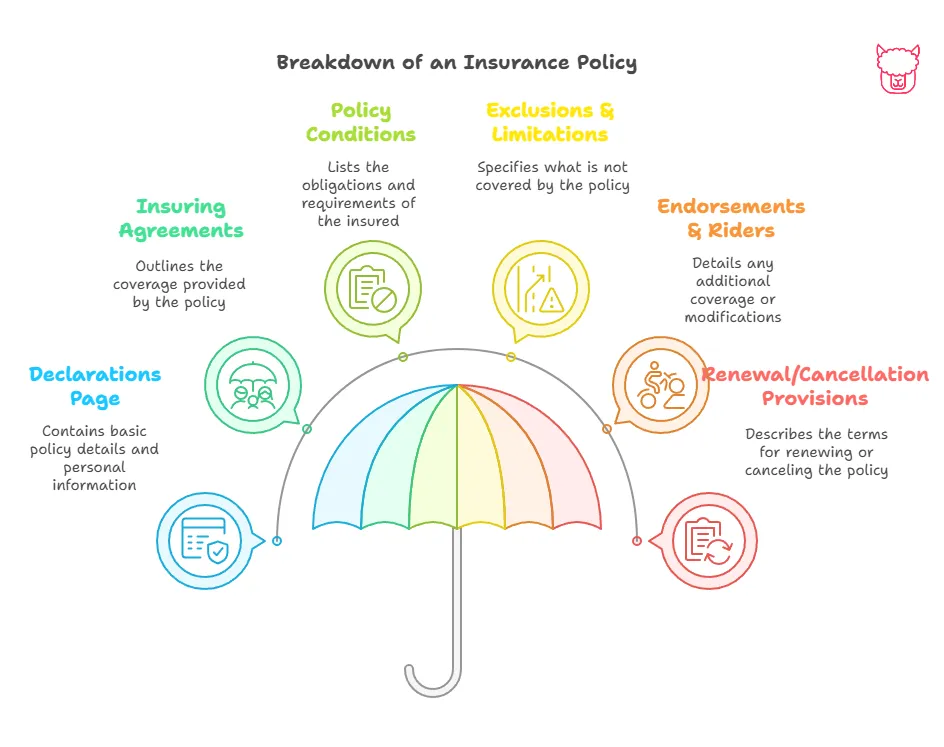

Key Components of an Insurance Policy

Insurance policies can sometimes feel complex and overwhelming, but understanding their key components is essential to ensure you’re fully aware of the coverage, rights, and responsibilities involved. Whether you’re purchasing auto insurance, homeowners insurance, or a specialized business policy, the structure of most insurance policies follows a similar format that has been standardized across the industry to provide clarity and consistency.

Understanding these components is crucial because insurance policies are legal contracts that establish the terms of coverage, define obligations for both parties, and determine how claims will be handled. Each section serves a specific purpose in creating a comprehensive agreement that protects both the insurer and the policyholder.

1. Declarations Page

The declarations page, often referred to as the “dec page” or “declarations sheet,” is the summary section of your insurance policy that serves as your primary reference document. This legally significant document forms part of your insurance contract and provides an at-a-glance overview of your coverage specifics.

Key Information Included:

- Policyholder information: Full legal name, mailing address, and contact information

- Policy identification: Unique policy number, form numbers, and edition dates

- Insured property or individuals: Detailed descriptions of covered property, vehicles, or people

- Policy period: Exact effective and expiration dates and times

- Coverage details and limits: Maximum amounts payable for each type of coverage

- Premium information: Total costs, payment schedules, and applied discounts

- Deductibles: Amounts you pay out-of-pocket before coverage applies

- Mortgagee or lienholder information: Third parties with financial interests

- Agent or broker information: Contact details for your insurance professional

Importance: The declarations page serves as proof of insurance, a quick reference for policy details, and the foundation for understanding your coverage. It’s essential to review this document carefully upon receipt and whenever changes are made to ensure accuracy.

2. Insuring Agreements

The insuring agreements represent the heart of your insurance policy—the formal promise your insurer makes to provide coverage. This section establishes the fundamental terms of your insurance contract and defines the scope of protection you’re purchasing.

Core Elements:

- Coverage grants: Specific promises to pay for covered losses

- Covered parties: Who is protected under the policy (named insureds, additional insureds, household members)

- Covered perils: Events or risks the policy protects against

- Geographic scope: Where coverage applies

- Time elements: When coverage is effective

Types of Coverage Approaches:

- Named-perils policies: Cover only specifically listed risks (fire, theft, windstorm)

- All-risk (open-perils) policies: Cover all risks except those specifically excluded

- Hybrid coverage: Different approaches for different parts of the same policy

Coverage Triggers:

- Occurrence-based: Coverage applies when the loss occurs during the policy period

- Claims-made: Coverage applies when the claim is made during the policy period

- Manifestation: Coverage applies when the loss is discovered or manifests

Legal Significance: Insuring agreements create binding contractual obligations and form the basis for coverage disputes. They work in conjunction with other policy sections to create a complete picture of your protection.

3. Policy Conditions

Policy conditions are the rules, duties, and obligations that both you and your insurer must follow for the policy to remain valid and enforceable. These legally binding provisions establish the framework for how the insurance relationship operates.

Types of Conditions:

- Conditions precedent: Requirements that must be met before coverage begins

- Conditions subsequent: Ongoing obligations throughout the policy period

- Conditions concurrent: Requirements that must be met simultaneously

Common Policy Conditions:

- Premium payment obligations: Requirements for timely payment to maintain coverage

- Notice requirements: Deadlines for reporting claims and material changes

- Cooperation duties: Obligations to assist with claim investigations

- Duty to mitigate damages: Requirements to prevent further loss after an incident

- Inspection and audit rights: Insurer’s rights to examine property and records

- Subrogation provisions: Insurer’s rights to recover from responsible third parties

- Cancellation and non-renewal procedures: Rules governing policy termination

Documentation and Compliance:

- Record keeping: Maintaining detailed documentation of covered property and operations

- Notification requirements: Informing the insurer of changes that may affect coverage

- Claim procedures: Following proper steps when filing claims

- Legal obligations: Complying with applicable laws and regulations

Consequences of Non-Compliance: Violating policy conditions can result in claim denials, policy cancellation, or voiding of coverage. Understanding and adhering to these conditions is essential for maintaining protection.

4. Exclusions and Limitations

This critical section details what is not covered by your policy and any restrictions that apply to your coverage. Exclusions and limitations serve important purposes in defining coverage scope, managing risk, and keeping premiums affordable.

Types of Exclusions:

- Standard exclusions: Common across most policies of the same type

- Conditional exclusions: Apply only under specific circumstances

- Specific exclusions: Tailored to particular risks or policy types

Common Categories of Exclusions:

- Intentional acts and criminal behavior: Deliberately caused damage or illegal activities

- War and terrorism: Large-scale conflicts and terrorist acts (may be available through separate coverage)

- Nuclear hazards: Nuclear reaction, radiation, or contamination

- Earth movement: Earthquakes, landslides, and volcanic eruptions

- Flood and water damage: Surface water and certain water-related losses

- Wear and tear: Normal deterioration and maintenance issues

- Professional liability: Errors in professional services (requires separate coverage)

Types of Limitations:

- Coverage limits: Maximum amounts payable for different types of losses

- Sub-limits: Specific limits for certain categories within broader coverage

- Time limitations: Restrictions based on time periods or waiting periods

- Geographic limitations: Coverage restrictions based on location

- Deductibles: Amounts you pay before insurance coverage applies

Managing Exclusions: Many exclusions can be addressed through endorsements, separate policies, or alternative coverage options. Understanding exclusions helps identify potential coverage gaps and make informed decisions about additional protection.

5. Endorsements and Riders

Endorsements (also called riders) are formal amendments that modify the terms of your insurance policy. These powerful tools allow you to customize coverage to meet specific needs, address unique risks, or comply with contractual requirements.

Types of Modifications:

- Coverage enhancements: Adding new types of protection or increasing limits

- Coverage restrictions: Excluding specific risks or reducing coverage

- Policy clarifications: Defining ambiguous terms or resolving conflicting provisions

- Regulatory compliance: Meeting state requirements or legal mandates

Common Endorsement Categories:

Property Insurance Endorsements:

- Scheduled personal property: Coverage for high-value items with agreed values

- Water backup coverage: Protection against sewer and drain backup

- Home business endorsements: Limited coverage for business activities

- Equipment breakdown: Coverage for mechanical and electrical failures

Liability Insurance Endorsements:

- Additional insured: Extending coverage to other parties

- Primary and non-contributory: Making your policy primary over others

- Waiver of subrogation: Preventing insurer recovery from specified parties

- Professional liability: Adding coverage for professional services

Auto Insurance Endorsements:

- Rideshare coverage: Protection for drivers using vehicles commercially

- Custom equipment: Coverage for aftermarket modifications

- Gap insurance: Protection against loan balance vs. actual cash value differences

Legal and Practical Considerations:

- Integration: Endorsements become part of the insurance contract

- Conflicts: Endorsements typically take precedence over base policy language

- Documentation: All modifications should be clearly documented and confirmed

- Cost impact: Endorsements may increase or decrease premiums

6. Renewal and Cancellation Provisions

These provisions explain the terms and procedures for continuing or terminating your insurance coverage. Understanding these rules is essential for maintaining continuous protection and avoiding coverage gaps.

Renewal Processes:

- Automatic renewal: Policies that renew automatically unless notice is given

- Manual renewal: Policies requiring active renewal decisions

- Guaranteed renewable: Policies that must be renewed if premiums are paid

- Conditionally renewable: Policies with specific renewal conditions

Renewal Considerations:

- Premium adjustments: Changes in costs based on claims experience or market conditions

- Coverage modifications: Updates to policy terms, limits, or conditions

- Notice requirements: Advance notification of renewal terms and changes

- Non-renewal situations: Circumstances that may lead to policy non-renewal

Cancellation Rights and Procedures:

Policyholder-Initiated Cancellation:

- Written notice requirements: Formal procedures for requesting cancellation

- Refund calculations: How unused premiums are calculated and returned

- Effective dates: When cancellation becomes effective

- Confirmation procedures: Obtaining written confirmation of cancellation

Insurer-Initiated Cancellation:

- Valid reasons: Grounds for mid-term cancellation (non-payment, fraud, material change in risk)

- Notice requirements: Advance warning periods required by law

- Legal protections: Consumer protections against unfair cancellation practices

- Due process: Procedures for disputing cancellation decisions

Avoiding Coverage Gaps:

- Replacement coverage: Ensuring new coverage is in place before canceling existing policies

- Coordination: Aligning effective dates to prevent lapses

- Documentation: Maintaining records of all coverage changes

- Professional guidance: Working with insurance professionals during transitions

Legal and Regulatory Framework

Contract Law Principles:

- Offer and acceptance: Insurance applications and policy issuance

- Consideration: Premium payments in exchange for coverage promises

- Legal capacity: Authority to enter into insurance contracts

- Mutual assent: Agreement to policy terms and conditions

Regulatory Oversight:

- State regulation: Insurance is primarily regulated at the state level

- Form approval: Policy forms must be approved by state insurance departments

- Rate regulation: Premium rates are subject to regulatory oversight

- Consumer protection: Laws protecting policyholders from unfair practices

Interpretation Principles:

- Ambiguity rule: Unclear language is interpreted in favor of the policyholder

- Reasonable expectations: Coverage should match reasonable policyholder expectations

- Contra proferentem: Contract terms are interpreted against the party who drafted them

Why Understanding These Components Is Critical

Legal Protection: When you purchase insurance, you’re entering into a legally binding contract. Each component serves specific legal purposes:

- Declarations: Establish the parties and basic terms

- Insuring agreements: Create enforceable coverage obligations

- Conditions: Define requirements for coverage validity

- Exclusions: Limit insurer liability and define coverage scope

- Endorsements: Modify and customize the agreement

- Renewal provisions: Govern contract continuation and termination

Financial Security: Understanding your policy components ensures:

- Adequate protection: Knowing what is and isn’t covered

- Proper claim handling: Understanding procedures and requirements

- Cost management: Making informed decisions about coverage levels

- Risk management: Identifying and addressing coverage gaps

Practical Benefits:

- Claims preparation: Knowing what documentation and procedures are required

- Coverage optimization: Making informed decisions about endorsements and modifications

- Compliance: Meeting policy conditions and requirements

- Professional relationships: Communicating effectively with insurance professionals

Best Practices for Policy Management

Initial Review:

- Thorough examination: Read and understand each policy component

- Professional consultation: Work with qualified insurance agents or brokers

- Documentation: Maintain organized records of all policy documents

- Questions and clarification: Address any unclear terms or provisions

Ongoing Management:

- Regular reviews: Assess coverage adequacy at least annually

- Change notifications: Report material changes that may affect coverage

- Condition compliance: Ensure ongoing adherence to policy requirements

- Professional relationships: Maintain regular contact with insurance professionals

Claim Preparedness:

- Documentation systems: Maintain records needed for potential claims

- Procedure familiarity: Understand claim reporting and handling procedures

- Contact information: Keep current contact information for insurers and agents

- Legal resources: Know when to seek professional legal or claims assistance

Key Takeaways

-

The declarations page serves as your policy summary and primary reference document, providing essential coverage details at a glance

-

Insuring agreements form the heart of your coverage, establishing what your insurer promises to protect and under what circumstances

-

Policy conditions create the operational framework for your coverage, establishing rules and obligations that must be followed by both parties

-

Exclusions and limitations define the boundaries of your coverage, clarifying what is not covered and any restrictions that apply

-

Endorsements and riders provide flexibility to customize your coverage, addressing unique needs and filling potential gaps

-

Renewal and cancellation provisions govern the continuation and termination of your coverage, ensuring you understand your options and obligations

-

Integration and interaction: All components work together to create a comprehensive insurance contract that balances protection with practical limitations

Understanding these key components ensures you know exactly what you’re paying for and how your policy protects you in times of need. This knowledge empowers you to make informed decisions, maintain proper compliance, and effectively manage your insurance program.

If you ever have questions about your policy components, don’t hesitate to reach out to an insurance professional for clarity. Insurance is a complex field, and professional guidance can help ensure you have appropriate protection for your specific needs and circumstances.

By gaining a deeper understanding of your policy’s structure, you can make smarter, more confident decisions about your insurance coverage and better protect yourself, your family, or your business against life’s uncertainties.

Need Help?

For assistance with your policy or to clarify details, contact Paca Insurance today. Our team is here to guide you through every aspect of your coverage and help you understand how each component works to protect your interests!

Next Steps

To further expand your knowledge and make the most of your insurance policy, consider exploring these related sections in the Policyholder’s Handbook:

1. Declarations Page

Dive deeper into understanding your policy’s summary document, including how to review it for accuracy and what each section means for your coverage.

2. Insuring Agreements

Explore the foundation of your insurance coverage in detail, learning about different types of coverage approaches and how insuring agreements create your protection.

3. Policy Conditions

Learn about the specific rules and obligations that govern your insurance relationship and how to ensure compliance with policy requirements.

4. Exclusions and Limitations

Gain a comprehensive understanding of what your policy doesn’t cover and how to identify and address potential coverage gaps.

5. Endorsements and Riders

Discover how to customize your insurance coverage to meet your specific needs through policy modifications and enhancements.

6. Renewal and Cancellation Provisions

Understand the procedures and requirements for maintaining, renewing, or canceling your insurance coverage while avoiding gaps in protection.