Risk Management Strategies: A Comprehensive Guide for Individuals and Businesses

Effective risk management is essential for safeguarding your financial well-being and ensuring long-term stability. Whether you’re an individual protecting your personal assets or a business managing operational risks, having a clear strategy in place is critical. In this guide, we’ll explore actionable risk management strategies tailored to both individuals and businesses, providing you with practical insights to minimize potential losses and improve your resilience.

What Is Risk Management?

Risk management involves identifying, assessing, and mitigating potential risks that could affect financial security, property, health, or operations. It encompasses a series of steps designed to help individuals and businesses prepare for unforeseen circumstances, such as accidents, natural disasters, legal liabilities, and economic disruptions.

Risk Management Strategies for Individuals

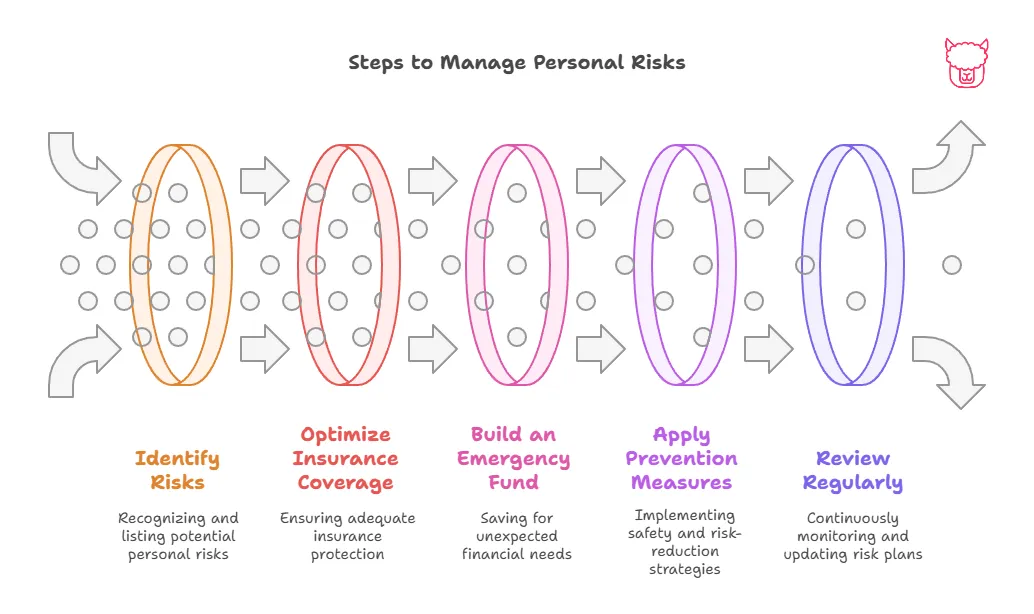

1. Identify Potential Risks

Start by evaluating areas of your life where risks might arise. Common personal risks include health issues, property damage, vehicle accidents, and loss of income.

- Examples of Risks:

- Health-related risks such as unexpected medical expenses.

- Financial risks, including job loss or market downturns.

- Liability risks, such as being sued for damages caused by negligence.

2. Review and Optimize Your Insurance Coverage

Insurance is a cornerstone of personal risk management. It provides a financial safety net, ensuring you’re protected against major losses.

- Recommended Policies:

- Health Insurance: Covers medical expenses and protects against rising healthcare costs.

- Auto Insurance: Protects against vehicle-related accidents and liability.

- Homeowners or Renters Insurance: Covers property damage and personal belongings.

- Life Insurance: Provides financial security for loved ones in the event of your death.

- Disability Insurance: Replaces income if you’re unable to work due to illness or injury.

3. Create an Emergency Fund

Establishing an emergency savings account ensures that you have funds available in case of unexpected events, reducing the need to rely on credit cards or loans.

- How Much Should You Save?

Aim for three to six months’ worth of living expenses in an easily accessible account.

4. Apply Loss Prevention Techniques

Proactively prevent risks where possible. This not only saves money but also gives you peace of mind.

- Examples:

- Install smoke detectors and security systems in your home.

- Perform regular car maintenance.

- Follow safety best practices, such as wearing seat belts and avoiding texting while driving.

5. Regularly Review Your Risks

Life evolves—whether through marriage, the birth of a child, or career changes—so your risk profile will also change. Periodically review and adjust your risk management plan to reflect your current circumstances.

Risk Management Strategies for Businesses

1. Risk Assessment and Identification

Begin with an in-depth analysis of possible risks to your business operations. Categorize them into different areas, such as financial, operational, legal, technological, and reputational risks.

- Examples of Risks:

- Economic downturns that impact revenue.

- Cyberattacks compromising customer data.

- Disruptions in the supply chain.

- Workplace injuries or accidents.

2. Develop a Risk Mitigation Plan

After identifying risks, create a plan to minimize their potential impact. This could include implementing policies, investing in technology, or training employees.

- Steps:

- Prioritize risks based on their likelihood and potential impact.

- Allocate resources to address high-priority risks first.

- Delegate risk management responsibilities to relevant personnel or teams.

3. Secure Comprehensive Business Insurance

Insurance plays an integral role in transferring and managing risks for businesses. Evaluate your needs and choose coverage accordingly.

- Key Insurance Policies for Businesses:

- General Liability Insurance: Covers claims of bodily injury or property damage caused by your business operations.

- Workers’ Compensation Insurance: Protects employees who are injured on the job and fulfills legal requirements in most states.

- Business Interruption Insurance: Replaces lost income during temporary shutdowns caused by events like natural disasters.

- Cyber Liability Insurance: Offers financial protection in case of data breaches or cyberattacks.

4. Promote a Culture of Safety and Awareness

Encourage employees to play an active role in minimizing risks by fostering a safety-conscious culture. Implement training programs, encourage incident reporting, and reward safe practices.

- Examples of Initiatives:

- Host regular safety drills and workshops.

- Implement cybersecurity training to reduce phishing attacks.

- Enforce compliance with industry regulations and standards.

5. Diversify Revenue Streams

Relying too heavily on a single client, product, or market can expose your business to significant financial risk. Mitigate this by diversifying income sources.

- How to Diversify:

- Expand into new market segments.

- Offer complementary products or services.

- Form partnerships to tap into new customer bases.

6. Create a Business Continuity Plan (BCP)

A well-constructed BCP ensures your business can continue operating or recover quickly during disruptions. Include contingency plans for utilities, critical supplies, communication systems, and workforce availability.

Safety and Preparedness: A Shared Approach

Both individuals and businesses can adopt a proactive approach to safety and emergency preparedness to minimize the impact of unforeseen events.

Key Safety Measures:

- Emergency Kits: Compile first-aid supplies, non-perishable food, water, and tools for emergencies.

- Backup Systems: Use cloud backups for vital documents (for personal use) or business data storage.

- Regular Reviews: Update safety equipment, policies, and plans annually or after major changes.

Why Insurance Is a Critical Part of Risk Management

Insurance doesn’t eliminate risks entirely, but it provides a crucial safety net that ensures financial recovery after a loss. Working with a trusted insurance provider like Paca Insurance ensures that your coverage is customized to your needs, offering peace of mind for both individuals and businesses.

Conclusion

Risk management is an ongoing process that requires vigilance, adaptability, and strategic planning. By identifying potential risks, implementing mitigation strategies, and leveraging insurance coverage effectively, you can reduce vulnerabilities and create a more secure future. Whether you’re protecting your family or your business, a proactive approach to risk management ensures you’re prepared for whatever life may bring.

At Paca Insurance, we’re committed to helping policyholders like you navigate risk with confidence. Contact us today to discuss how our insurance solutions can complement your risk management strategies.

For more helpful resources, visit our Risk Management Center or contact a Paca Insurance agent today!

Next Steps

To continue building your knowledge and making the most of the Policyholder’s Handbook, consider exploring the following related sections:

-

The Role of Insurance in Risk Management

Gain insight into how insurance plays a fundamental role in mitigating risks for both individuals and businesses. Perfect for understanding how insurance is integrated into risk management plans. -

Personal Liability Insurance

Learn about how personal liability insurance can protect you against claims of negligence and other personal liability risks. -

Utilizing Insurance as Part of a Comprehensive Risk Management Plan

Dive deeper into how individuals and businesses can incorporate insurance as a core component of a wider risk management strategy. -

General Liability Insurance

Explore a key coverage for businesses and understand how it guards against risks that could jeopardize your business operations. -

Exclusions and Limitations

Discover which areas a policy might not cover and how those exclusions could impact your overall risk management strategy.