The Claims Process: A Comprehensive Guide

Claims Journey Overview

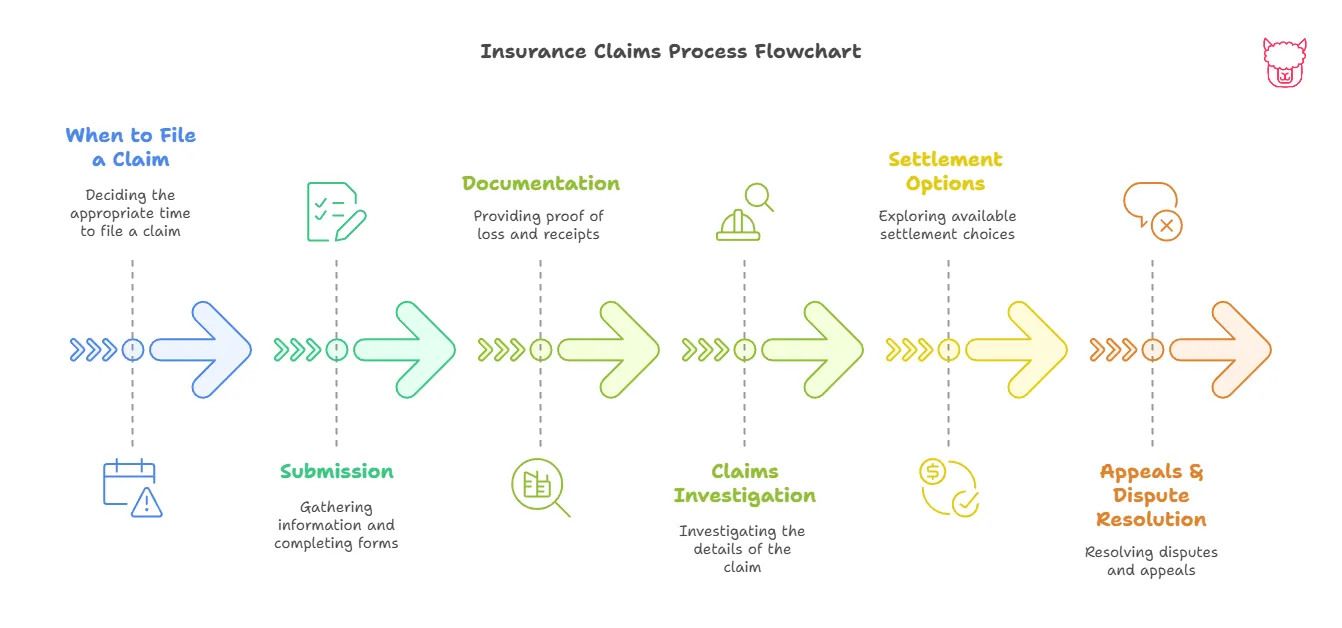

Filing an insurance claim is often the first step in recovering from events like accidents, property damage, or unforeseen losses. Understanding the claims process can ease the stress of navigating this critical stage, ensuring you receive the coverage and support you need promptly. This guide walks you through every step, from initiating your claim to final resolution, offering helpful tips along the way.

Key Steps in the Insurance Claims Process

1. When to File a Claim

Knowing when to file a claim is critical. You should consider filing when:

- The cost of damages or losses exceeds your deductible.

- Mandated by law, such as after an auto accident in certain states.

- Other parties are involved, and liability needs to be determined.

Before filing, assess the situation and determine if pursuing a claim is the right course of action. Filing unnecessarily for minor incidents may lead to higher premiums over time.

2. How to File a Claim

Filing a claim involves notifying your insurer about the incident and initiating the claims process. Here’s a step-by-step guide:

Gather Essential Information

Collect all relevant details about the event, including:

- Date, time, and location of the incident.

- Names and contact information of involved parties.

- Photos or videos documenting the damage or loss.

- A copy of your policy to reference coverage details.

If it’s an auto accident, obtain a police report if available, as it can serve as crucial documentation.

Contact Your Insurance Provider

Notify your insurer as soon as possible. You can file claims through:

- Your provider’s online portal.

- Their mobile app, if available.

- A claims hotline or by contacting your agent.

Provide all required information during the initial contact to expedite the process.

Complete Required Forms

Your insurer may ask you to fill out claim forms, detailing the incident and damages. Submit these promptly to avoid delays. Be thorough and accurate in your descriptions.

3. Documentation Needed for Claims

Proper documentation is the backbone of a successful claim. Ensure you have the following:

- Proof of Loss: Photos or videos showing the extent of the damage.

- Receipts or Bills: Proof of the value of damaged assets or costs incurred.

- Police Reports: If applicable, these provide an official record of the incident.

- Estimates or Invoices: For repairs or replacements.

Keep copies of all documents for your records.

4. The Claims Investigation Process

Once your claim is filed, your insurer will begin an investigation to verify its validity and assess coverage under your policy. Key steps include:

- Assigning an Adjuster: A claims adjuster will be assigned to evaluate your case.

- On-Site Inspections: For certain claims, such as property damage, the adjuster may visit to inspect the damage.

- Interviews: You or other parties involved may be interviewed to provide context for the claim.

- Review of Evidence: The insurer will review all submitted documentation.

During this phase, it’s important to stay responsive and cooperate fully with your insurer’s requests.

5. Settlement Options and Procedures

Following the investigation, your insurer will determine the settlement amount based on your policy terms. Common options include:

- Repair or Replacement: Covering the costs of repairs or providing replacements for damaged property.

- Payment to You: Issuing a payment directly to you, depending on the value of your loss.

- Third-Party Settlements: In liability claims, payments may also be made to affected parties.

Carefully review the settlement offer. If you disagree with the amount, you can negotiate or appeal (discussed below).

6. Appeals and Dispute Resolution

If you feel the claim has been unfairly denied or undervalued, you have options to dispute the decision:

- Provide Additional Evidence: Submit further documentation to support your claim.

- Request a Reassessment: Ask for another claims adjuster to review your case.

- Engage in Mediation: Many insurers offer mediation services to resolve disputes.

- File a Complaint: If necessary, you can escalate the matter to your state’s department of insurance.

A polite but firm approach can often resolve disputes amicably.

7. Tips for a Smooth Claims Experience

- Act Quickly: File your claim as soon as possible to prevent delays.

- Keep Records: Maintain copies of all correspondence, documents, and receipts.

- Be Thorough: Provide clear and accurate information in your claim.

- Stay Communicative: Respond promptly to requests from your insurer.

- Understand Your Policy: Familiarize yourself with your coverage limits, exclusions, and deductible obligations.

A proactive attitude can go a long way in simplifying the process.

Common Challenges in the Claims Process

Despite your best efforts, claims can sometimes encounter roadblocks. Here are examples and advice on handling them:

- Delays in Processing: Contact your insurer for updates and maintain frequent communication.

- Claim Denials: Review the denial letter closely and look for errors or omissions in your submission.

- Insufficient Settlement Offers: Research the fair market value of your loss, and present evidence to support negotiation.

Your insurance provider wants to protect you, so working collaboratively usually resolves most issues.

Conclusion

The insurance claims process may seem daunting, but understanding how it works equips you to handle it confidently and efficiently. From filing your claim to negotiating a fair settlement, every step plays a crucial role in safeguarding your financial stability during challenging times.

Remember these key takeaways:

- File your claim quickly and accurately.

- Provide thorough documentation to support your case.

- Maintain clear communication with your insurer.

- Know your rights and explore dispute resolution if necessary.

Paca Insurance is here to guide and support you every step of the way. If you have any questions or need assistance during your claims process, contact us anytime. Protecting you is our priority.

References:

- National Association of Insurance Commissioners (NAIC): Consumer Insurance Information

- Insurance Information Institute: Filing an Insurance Claim

Next Steps

To ensure you continue learning about how to manage your insurance policies effectively and make the most of your coverage, we recommend exploring the following sections of the Policyholder’s Handbook:

-

Understanding Coverage Limits

Gain a deeper understanding of insurance coverage limits, how they impact your financial protection, and what to consider when selecting the right level of coverage. -

How Insurance Works: Premiums, Claims, and Payouts

Discover the mechanics of insurance policies, including how premiums are calculated, how claims are processed, and what determines policy payouts. -

Appeals and Dispute Resolution

If you find your claim denied or undervalued, this section provides in-depth guidance on how to dispute claims, submit appeals, and resolve conflicts effectively. -

Policy Endorsements and Customization

Learn how to tailor your insurance policy with endorsements and riders to better suit your personal or business needs. -

Your Rights as a Policyholder

Familiarize yourself with the rights and protections you have as a policyholder so you can advocate for yourself with confidence during the claims process.