How Insurance Works: Premiums, Claims, and Payouts

Insurance may seem complicated at first glance, but its basic principles are fairly straightforward. At its core, insurance functions as a financial safety net designed to protect you from unexpected losses. To truly appreciate its role, it’s essential to understand three key elements: premiums, claims, and payouts. These components form the backbone of how insurance works.

Who this helps (at a glance)

- New buyers learning core mechanics

- Policyholders preparing to file a first claim

- Households budgeting premiums and deductibles

- Students and professionals studying insurance operations

State specifics at a glance

- Claims deadlines, appraisal/arbitration, and complaint processes vary by state.

- Unfair claims practices acts and timelines are jurisdiction‑specific.

- Keep DOI contact info handy for escalations if needed.

Use Paca to navigate the cycle

- Upload your policies — we surface premium cadence, deductibles, and OOP max.

- Turn on Claims Mode — a guided checklist for documentation and deadlines.

- Track payments and EOBs — centralize communications and adjuster notes.

- Export a cost summary — premiums vs claims to inform renewal decisions.

- Keep reminders — statute/notice windows and follow‑ups don’t get missed.

Related reading

- The Claims Process: When and How to File

- Understanding Coverage Limits

- The Role of Insurance in Risk Management

- Key Components of an Insurance Policy

What Are Premiums?

Premiums are the payments you make to an insurance company in exchange for coverage. Whether paid monthly, quarterly, or annually, the premium is the cost of transferring your financial risk to the insurer. Think of it as your ticket into the insurance pool—this pool allows insurers to collect funds from many policyholders to cover any potential losses they might have to pay out.

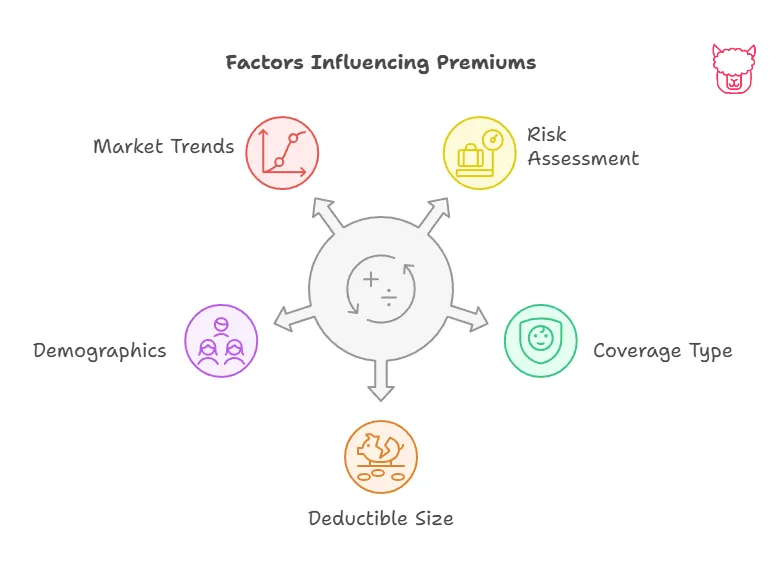

How Are Premiums Calculated?

Premiums are not arbitrary. They’re calculated based on a variety of factors, including:

- Risk Assessment: Insurers evaluate the likelihood of you filing a claim. For example, a driver with a clean driving record typically pays a lower premium than someone with a history of accidents.

- Coverage Type and Limits: More extensive coverage or higher coverage limits result in higher premiums.

- Deductible Size: Choosing a higher deductible (the amount you pay out of pocket before insurance kicks in) usually lowers your premium.

- Demographic Categories: Factors like age, location, and even occupation can influence your premium costs, as some groups are statistically more likely to file claims.

- Market Factors: Inflation, industry trends, and external economic conditions also play a role in determining premium rates.

By paying your premium consistently and on time, you maintain active coverage under your policy.

What Are Claims?

Insurance claims are requests made by policyholders to their insurer for financial compensation after experiencing a covered loss. Filing a claim initiates the process in which the insurer evaluates your situation to determine if they will pay for the damages or expenses outlined in your policy.

Types of Claims

Claims can apply to various scenarios, depending on your specific policy. Common examples include:

- Auto Insurance Claims: To repair or replace your vehicle after an accident.

- Health Insurance Claims: To cover medical expenses following an illness or injury.

- Homeowners Insurance Claims: For damages caused by events like fires, storms, or theft.

- Life Insurance Claims: To provide financial benefits to a beneficiary after the policyholder’s death.

How to File a Claim

Filing a claim generally requires the following steps:

- Notify Your Insurer: Contact your insurance provider as soon as possible to inform them of the incident.

- Document the Incident: Provide all necessary information, such as photos, receipts, medical bills, police reports, or other evidence. Proper documentation strengthens your case for reimbursement.

- Submit Your Claim Form: Fill out your insurer’s claim form completely and accurately. Most insurance companies allow you to file claims online for convenience.

- Communicate With the Adjuster: An insurance adjuster may be assigned to evaluate the legitimacy of the claim and assess the extent of the damages.

- Follow-Up: Stay in touch with your insurance provider to ensure your claim is being processed without delays.

What Are Payouts?

After your claim is approved, the insurance company issues a payout, which is the agreed-upon amount of money or services provided to cover your loss. The payout brings your coverage to life, protecting you financially from unexpected costs.

Factors That Influence Payouts

Several factors determine the size and timing of a payout:

- Policy Coverage Limits: Your policy specifies the maximum amount the insurer will pay for certain types of claims.

- Deductibles: The payout is reduced by the amount of your deductible, which you’re responsible for covering.

- Policy Exclusions: If the loss involves circumstances excluded from your policy, the payout may be reduced or denied altogether.

- Proof of Loss: The payout depends on the documentation you’ve submitted as proof of the incident.

Depending on the nature of the insurance and the claim, payouts may come as either a single lump sum or a series of ongoing payments. For example, life insurance usually issues a one-time lump sum, while health insurance might make multiple payments over time for ongoing medical treatments.

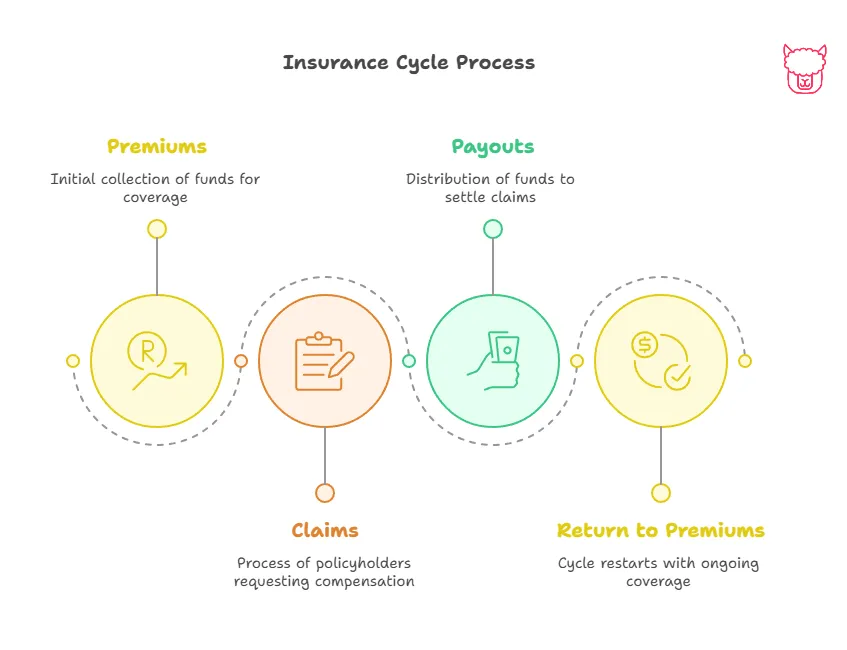

How the System Works Together

To see how premiums, claims, and payouts interact, let’s consider an example:

- Premiums: You purchase an auto insurance policy by paying a monthly premium of $100.

- Claim: You’re involved in a car accident, sustaining $10,000 in vehicle damage.

- Payout: You file a claim, and after verifying the details and you paying a $1,000 deductible, your insurer issues a $9,000 payout to cover the remaining cost of repairs.

This process highlights how your premiums provide peace of mind, even if you never need to use the policy. And when something unavoidable happens? The insurer steps in to ease the financial burden.

Why Understanding This Matters

Grasping how insurance premiums, claims, and payouts work can help you make better decisions when selecting and managing your insurance policies. Understanding the relationship between these components:

- Empowers you to choose the right coverage for your needs.

- Helps you avoid surprises, like unexpected exclusions or high out-of-pocket costs.

- Encourages proactive communication with your insurance provider during the claims process.

Key Takeaways

- Premiums, claims, and payouts form the core mechanics of how insurance works.

- Premiums are calculated based on risk, coverage, and other factors.

- Filing an accurate and well-documented claim is critical for securing a payout.

- Payouts provide financial protection by covering unexpected losses.

By understanding these foundational elements, you’ll be better equipped to maximize your insurance benefits and get the most value from your policy. Insurance isn’t just a contract—it’s a partnership designed to safeguard your financial well-being.

For more guidance, don’t hesitate to contact your Paca Insurance representative!

References

- NAIC — Consumer’s Guide to Filing a Claim — https://content.naic.org/consumer.htm

- Insurance Information Institute (III) — How Claims Work — https://www.iii.org

- NAIC — Unfair Claims Settlement Practices Acts (overview) — https://content.naic.org

- State Insurance Departments — File a Complaint — https://content.naic.org/state-insurance-departments

Premium → Claim → Payout

-

Pay premiums on schedule to keep coverage active.

-

Covered loss occurs; document and notify promptly.

-

File claim with required evidence; cooperate with adjuster.

-

Deductible applies; payout issued up to policy limits.

-

Review at renewal: adjust limits/deductibles as needed.

-

Pay premiums on schedule to keep coverage active.

-

Covered loss occurs; document and notify promptly.

-

File claim with required evidence; cooperate with adjuster.

-

Deductible applies; payout issued up to policy limits.

-

Review at renewal: adjust limits/deductibles as needed.