Understanding Insurance Basics

Insurance at a Glance

Insurance plays a crucial role in providing financial protection against unforeseen events. Whether it’s safeguarding your home, car, health, or business, understanding the basics of insurance can empower you to make informed decisions. This guide introduces essential insurance concepts and principles to help you navigate the world of coverage with confidence.

The Fundamentals

At its core, insurance is a contract between an individual (the policyholder) and an insurance company. The policyholder pays a premium, and in return, the insurer agrees to provide financial compensation or assistance for specific losses, damages, or risks outlined in the policy.

Think of insurance as a safety net—designed to reduce the financial impact of life’s uncertainties, such as accidents, natural disasters, or unexpected illness.

The Role of Insurance in Risk Management

Life is unpredictable, and risks are an inherent part of our daily activities. Insurance serves as a vital tool in risk management, helping us prepare for potential financial challenges. Here’s how insurance supports this process:

- Risk Transfer: By purchasing insurance, policyholders transfer the financial burden of a potential loss to the insurance company.

- Loss Mitigation: Insurance minimizes the impact of a loss, ensuring financial stability and peace of mind.

- Asset Protection: It protects valuable assets—like your home, vehicle, or business—against risks such as theft, accidents, or disasters.

- Legal Compliance: Certain types of insurance, such as auto insurance, are legally required in many jurisdictions to protect public safety.

How Insurance Works: Premiums, Claims, and Payouts

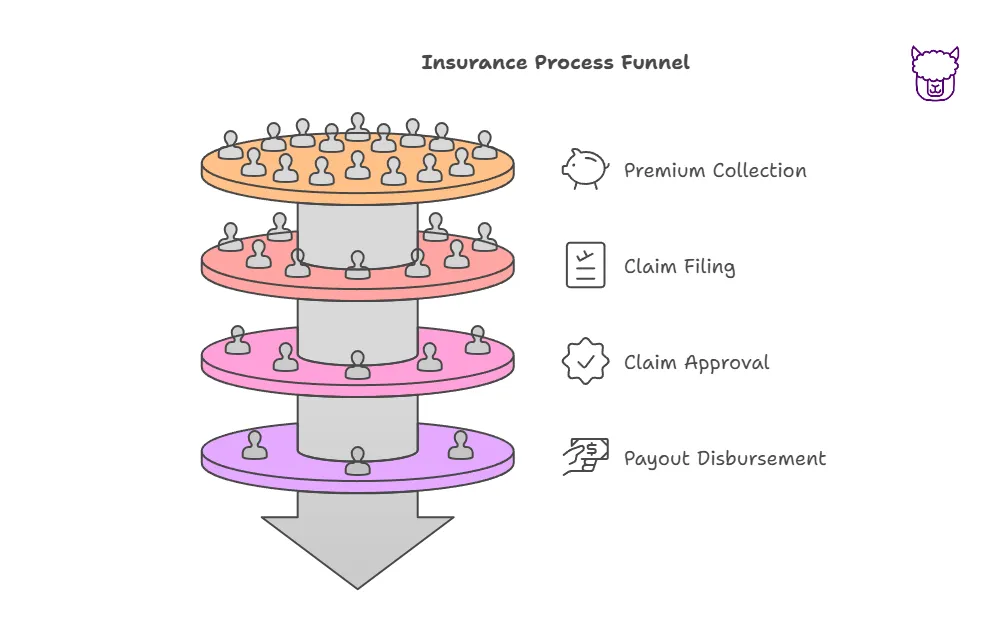

Insurance operates on the principle of pooling risk. A large group of people pays premiums into a collective fund managed by the insurer. Here’s how the process unfolds:

-

Premiums:

A premium is the amount you pay the insurer, usually monthly or annually, for coverage. The amount depends on factors like the type of policy, coverage limits, your age, location, and risk profile. -

Claims:

If an insured event occurs (e.g., a car accident or medical emergency), you or a designated beneficiary can file a claim with the insurer. The claim is a formal request for the insurer to cover the financial loss or provide compensation, as specified in your policy. -

Payouts:

Once the insurer approves the claim, they issue a payout, either as a lump sum or in installments, to help you recover from the loss. The payout amount is subject to the terms, conditions, and limits of the policy.

Key Principles of Insurance

Insurance is built on the following foundational principles, ensuring fair and transparent practices for both policyholders and insurers:

-

Principle of Utmost Good Faith:

Both parties (the insurer and policyholder) are obligated to act in good faith. This means providing accurate information during policy underwriting and claims. -

Principle of Insurable Interest:

The policyholder must have a legitimate financial or personal stake in the insured asset or individual. For instance, you can insure your home, but not a property owned by someone else. -

Principle of Indemnity:

Insurance aims to restore the insured party to their financial position before the loss—no more, no less. This prevents individuals from profiting from insurance claims. -

Principle of Contribution:

If multiple insurers cover the same risk, they share the financial responsibility for a claim proportionately. -

Principle of Subrogation:

Once a claim is paid, the insurer may pursue a third party responsible for the loss to recover the costs. -

Principle of Loss Minimization:

Policyholders are expected to take reasonable steps to minimize the damage or loss, even after buying insurance.

Why Understanding Insurance Is Important

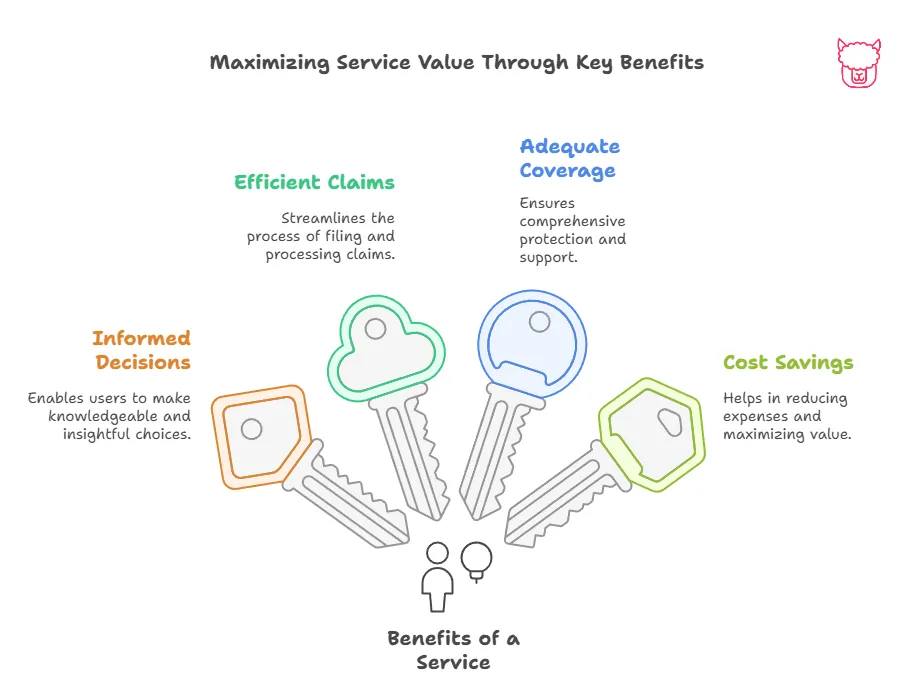

Being informed about the basics of insurance is more than just fulfilling a legal requirement or ticking off administrative tasks—it’s a tool for empowerment. Here’s why comprehending these concepts benefits you:

- Informed Decision-Making: Choose coverage that aligns with your needs and financial goals.

- Efficient Claims Process: Understand the steps and documentation required to file claims successfully.

- Avoiding Underinsurance: Ensure you have adequate coverage to protect against significant financial risks.

- Cost Savings: Know how factors like deductibles and coverage levels impact premiums, helping you balance costs and benefits.

By being informed you maximize the value that is being provided to you by your existing policies in order to realize the maximum benefits

Common Misconceptions About Insurance

To make well-informed decisions, it’s also essential to avoid common myths surrounding insurance. Let’s address a few:

-

“Insurance is only for emergencies.”

While insurance primarily provides financial support during emergencies, it also offers benefits like preventive health coverage or business income protection. -

“Cheaper policies are always better.”

Lower premiums often mean reduced coverage. It’s critical to evaluate the trade-offs before choosing a policy. -

“I don’t need insurance because I’m careful.”

Even the most cautious individuals can face unforeseen risks like natural disasters or medical emergencies.

Conclusion

Understanding the basics of insurance is the first step in protecting your financial well-being. With a clear grasp of key concepts like premiums, claims, and coverage principles, you’re better equipped to assess your personal or business needs and secure the right policy. Remember, insurance is not a one-size-fits-all solution—your coverage should evolve as your life changes.

At Paca Insurance, we’re committed to helping policyholders navigate the complexities of insurance with clarity and confidence. If you have further questions, feel free to explore other sections of this handbook or contact our team for tailored assistance. Taking the time to educate yourself today can help you safeguard your tomorrow.

Next Steps

Understanding insurance basics is just the beginning! To deepen your knowledge and make the most of Paca Insurance’s resources, here are some recommended sections from the Policyholder’s Handbook to explore next:

-

What Is Insurance?

Get a clearer picture of what insurance is and why it’s important for managing life’s uncertainties. -

The Importance of Being Informed

Learn why staying informed is essential for making smarter insurance decisions and avoiding unnecessary risks. -

Types of Insurance Policies

Explore the various personal and business insurance policy types and find out which best suits your needs. -

The Role of Insurance in Risk Management

Dive deeper into how insurance integrates into managing risks effectively for yourself, your family, or your business. -

How Insurance Works: Premiums, Claims, and Payouts

Gain a better understanding of the key processes behind insurance, including premiums, claims, and payouts.

These additional sections will provide you with a comprehensive understanding and practical insights to help you become more confident in navigating insurance policies and protecting what matters most.

Ready to take control of your insurance journey? Start exploring now!