Personal Insurance: An Overview of Types and Their Importance

Personal insurance covers various types of insurance policies designed to protect individuals and families from financial loss due to unforeseen events. These policies provide a safety net for your most valuable assets—your health, life, property, and overall well-being. Choosing the right personal insurance coverage is essential for mitigating risks and ensuring financial stability in the face of life’s uncertainties.

In this article, we’ll explore the different types of personal insurance policies and highlight why they are a crucial part of your financial planning.

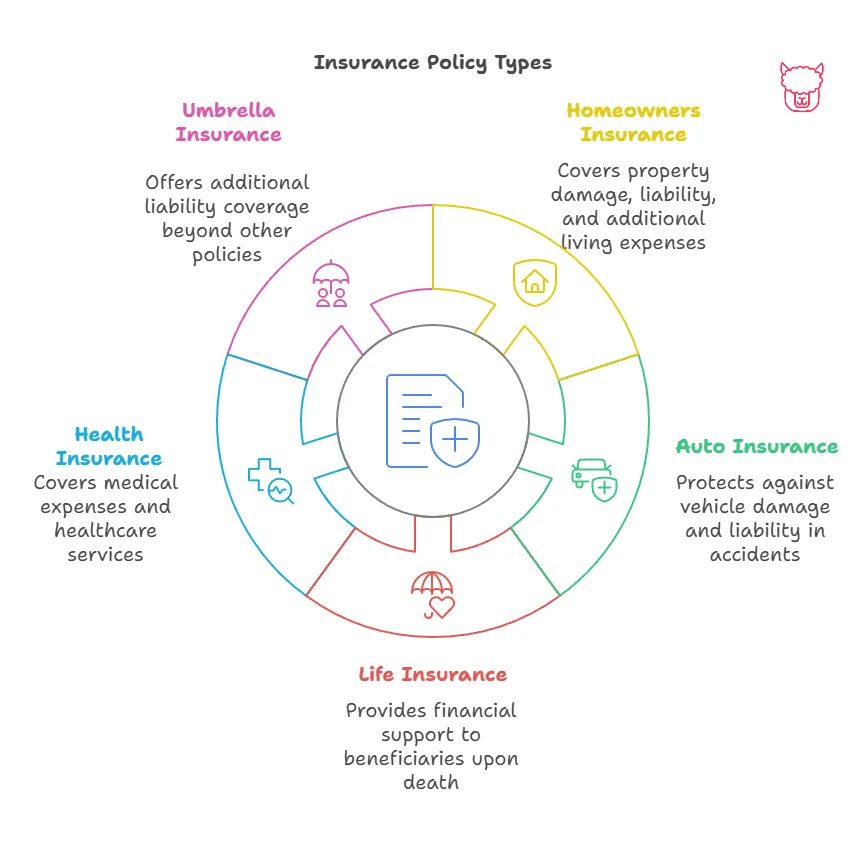

Types of Personal Insurance

1. Auto Insurance

Auto insurance is essential for protecting you against the financial consequences of car accidents, theft, or vehicle damage. Depending on the coverage type, it can pay for repairs, medical expenses, or legal liabilities arising from an accident. Most states require some level of auto insurance, making it a legal necessity for drivers.

Common Types of Auto Insurance Coverage:

- Liability coverage

- Collision coverage

- Comprehensive coverage

- Uninsured/underinsured motorist coverage

2. Homeowners and Renters Insurance

Your home is one of your most significant investments, and homeowners insurance safeguards it against risks like fire, theft, vandalism, or natural disasters. For renters, this type of insurance provides protection for personal belongings and liability coverage.

Key Coverage Options:

- Structure and dwelling protection

- Personal property coverage

- Liability coverage

- Additional living expenses (if your home becomes uninhabitable)

3. Life Insurance

Life insurance provides financial support to your loved ones in the event of your passing. It helps cover expenses like funeral costs, outstanding debts, or income replacement. This type of insurance is particularly important for ensuring your family’s financial security in your absence.

Primary Types of Life Insurance:

- Term life insurance (coverage for a specified period)

- Whole life insurance (permanent coverage with a savings component)

- Universal life insurance (flexible premiums and coverage)

4. Health Insurance

Health insurance is critical for managing the escalating costs of medical care. It helps cover expenses like doctor visits, hospital stays, prescription drugs, and preventive care. Having health insurance reduces the financial burden of unexpected illnesses or injuries and ensures access to quality healthcare.

Common Health Insurance Plans:

- Employer-sponsored health plans

- Individual and family health plans

- Government programs like Medicare and Medicaid

5. Disability Insurance

Disability insurance provides income replacement if you become unable to work due to a disabling condition or injury. It helps ensure that your living expenses and financial obligations are met, even if your ability to earn a paycheck is compromised.

Types of Disability Insurance:

- Short-term disability insurance (typically covers up to six months)

- Long-term disability insurance (covers extended periods of time, potentially until retirement)

6. Personal Liability Insurance

Personal liability insurance protects you from legal and financial risks if you’re held responsible for bodily injuries or property damage to someone else. It’s often included in homeowners or renters insurance policies but can also be purchased as a standalone umbrella policy for higher coverage limits.

Why Personal Insurance Is Important

- Financial Security: Personal insurance protects your savings and assets from unexpected expenses such as medical bills, property damage, or lawsuits.

- Risk Management: It provides a safety net against potential risks, helping you recover quickly from events like accidents, natural disasters, or illnesses.

- Peace of Mind: Knowing you and your family are financially protected allows you to focus on living your life without constant worry about potential crises.

- Legal Compliance: Certain types of insurance, such as auto insurance, are legally required, ensuring compliance with state and federal laws.

- Family Protection: Life insurance and health insurance ensure your loved ones are cared for in case you’re unable to provide for them due to illness, injury, or death.

Choosing the Right Personal Insurance

When selecting personal insurance, consider the following factors:

- Your financial goals and needs

- The value of assets you want to protect

- Potential risks specific to your lifestyle or location

- Coverage limits and premiums that fit your budget

Consulting with an insurance agent or broker can help you evaluate your needs and customize your policies to provide optimal protection.

Conclusion

Personal insurance is a cornerstone of a solid financial plan, offering protection for your health, assets, income, and loved ones. By understanding the various types of personal insurance policies available, you can make informed decisions that help safeguard against life’s uncertainties. From auto and homeowners insurance to health and life insurance, these policies ensure that you’re prepared for the unexpected, providing peace of mind and financial stability.

For tailored advice and a deeper understanding of your personal insurance options, reach out to a Paca Insurance agent today. Our team is committed to helping you find the right coverage to protect what matters most.

References

- National Association of Insurance Commissioners (NAIC): Understanding Insurance Basics

- Insurance Information Institute: Types of Insurance Coverage

Next Steps

Now that you’ve gained an overview of personal insurance and its significance, here are some recommended articles from the Policyholder’s Handbook to deepen your understanding and help you navigate your insurance journey effectively:

-

Types of Insurance: Explore a comprehensive breakdown of various insurance policies, including personal and business coverage, to gain insights into how they complement your overall protection plan.

-

How Insurance Works: Premiums, Claims, and Payouts: Learn about the mechanics of insurance, including how premiums are calculated, claims are processed, and payouts are structured—essential knowledge for any policyholder.

-

Understanding Coverage Limits: A deeper dive into how coverage limits affect your financial protection and how you can tailor policies to suit your specific risks and needs.

-

Risk Mitigation Strategies for Businesses: While focused on businesses, this article also includes valuable general tips on managing risks effectively, which can benefit individuals and families as well.

-

The Claims Process: When and How to File: Discover step-by-step guidance on filing insurance claims, ensuring a smooth and hassle-free experience when you need to access your coverage.