Exclusions and How They Impact Coverage

When purchasing an insurance policy, it’s easy to focus on the coverage details—the protection offered for your car, home, health, or business. However, equally important are the exclusions, which outline circumstances or events your policy does not cover. Insurance exclusions are a critical component of any policy and play a significant role in shaping your overall coverage. By thoroughly understanding these exclusions, you can avoid unwelcome surprises and be better informed about the protection your policy actually provides.

What Are Insurance Exclusions?

Exclusions in an insurance policy define the situations, events, or conditions in which the insurer will not pay for a claim. These exclusions are outlined in the policy documentation, often under a dedicated section titled “Exclusions” or “Exclusions and Limitations.” In simpler terms, exclusions reflect the limitations that set boundaries on your coverage.

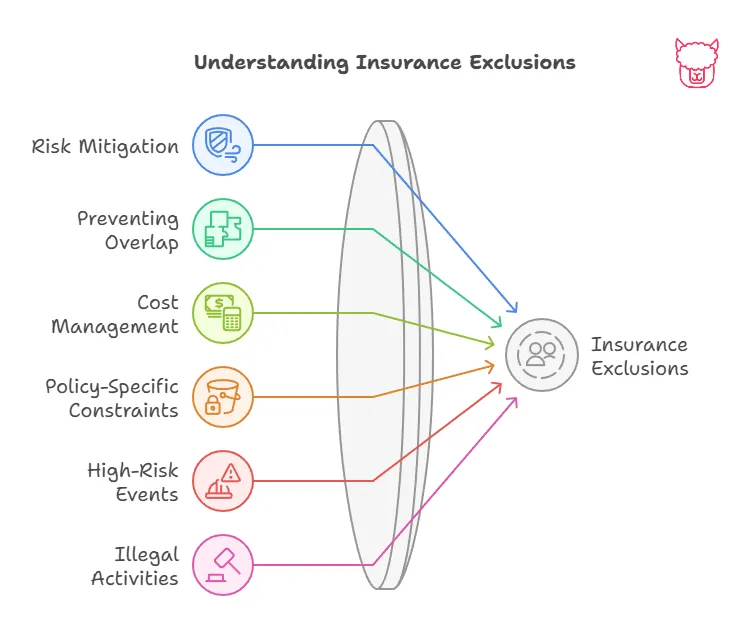

Exclusions are established for a variety of reasons, which may include:

- Risk Mitigation: Certain high-risk events may not be insurable or may require a different type of coverage.

- Preventing Overlap: Some exclusions exist to ensure multiple insurance policies don’t overlap in coverage.

- Cost Management: Removing certain high-cost risks helps insurers keep premiums affordable for policyholders.

Common Types of Insurance Policy Exclusions

While exclusions vary by type of policy and insurer, here are some of the most common examples across different insurance products:

1. Natural Disasters or “Acts of God”

- Many standard homeowners or business insurance policies exclude natural disasters such as earthquakes, floods, and hurricanes.

- Impact on Coverage: Damage caused by these excluded events will require separate coverage, such as earthquake insurance or flood insurance.

2. Wear and Tear

- Insurance policies, especially for property or vehicles, typically exclude coverage for routine wear and tear or maintenance issues, such as a leaking roof, rust, or engine failure.

- Impact on Coverage: These are considered the responsibility of the policyholder to repair or maintain.

3. Intentional Acts

- Insurance does not cover losses caused by intentional acts, such as deliberate destruction of property or fraud.

- Impact on Coverage: Claims related to intentional damage will be denied, and attempting such claims may lead to policy cancellation or legal consequences.

4. War, Terrorism, or Civil Unrest

- Events such as acts of war, terrorism, or large-scale civil unrest are frequently excluded from standard personal and business policies.

- Impact on Coverage: Separate policies, such as terrorism insurance, may be needed to manage these risks.

5. Certain Medical Conditions

- Health insurance policies often exclude coverage for pre-existing conditions or specific procedures, such as cosmetic surgeries, unless deemed medically necessary.

- Impact on Coverage: Policyholders may face out-of-pocket expenses for treatments not covered by their plan.

6. Professional Negligence

- General liability insurance for businesses typically excludes claims relating to professional errors or omissions.

- Impact on Coverage: Companies will need to purchase specialized policies, like professional liability insurance (also called errors and omissions insurance), for these risks.

7. Illegal Activities

- Losses incurred due to illegal activities are excluded from virtually all insurance policies.

- Impact on Coverage: For example, damage to your car while committing a crime will not qualify for coverage.

8. Policy-Specific Exclusions

- Policies may also include exclusions unique to the type of insurance. For instance:

- Auto Insurance: Excludes coverage for vehicles used for commercial purposes unless specified.

- Life Insurance: May exclude payment for suicide within the first few policy years.

- Travel Insurance: Often excludes pandemics, political unrest, or cancellations unrelated to covered events.

How Do Exclusions Impact Policyholders?

1. Reduced Financial Protection

Exclusions directly limit the financial security your insurance provides. If an excluded event occurs, you will have to cover the cost yourself.

2. The Need for Supplemental Coverage

Many exclusions require policyholders to purchase additional coverage or specialized insurance policies, such as flood insurance or professional liability coverage, to ensure comprehensive protection.

3. Potential for Misunderstanding

Failing to understand exclusions can lead to significant frustration and financial strain if a claim is denied. This underscores the importance of carefully reviewing your policy terms.

4. Greater Responsibility for Risk Management

Excluded risks shift the burden of risk management to you. This might involve upgrading property protection, maintaining your assets to prevent wear and tear, or creating an emergency fund for uncovered events.

How to Manage Insurance Exclusions

Navigating exclusions doesn’t have to feel overwhelming. Here are some tips to help:

-

Review Your Policy in Detail: Read the exclusions section carefully to know what is and isn’t covered.

-

Ask Questions: Don’t hesitate to ask your insurance agent or broker for clarification regarding exclusions in the policy.

-

Consider Supplemental Policies: Determine if you need additional insurance to cover excluded risks, like flood insurance or professional liability coverage.

-

Practice Risk Management: Implement safety measures to mitigate risks excluded by your policy, such as reinforcing your home against natural disasters or ensuring compliance with workplace safety regulations.

-

Stay Updated: Keep track of any changes to your policy, as exclusions may be updated at renewal or adjusted based on changes in regulations or coverage options.

Conclusion

Insurance exclusions are a critical part of your policy as they set limits on what your insurer will cover. Understanding these exclusions enables you to better assess your risks and make informed decisions about supplemental coverage. At Paca Insurance, we’re committed to helping you navigate your policy’s terms, ensuring you’re fully informed and adequately prepared. If you have questions about your policy’s exclusions or need help determining the right insurance options, our team is always here to assist you.

By being proactive and informed, you can minimize gaps in coverage and achieve peace of mind knowing you’re financially protected when you need it most.

Next Steps

To deepen your understanding of insurance policies and ensure you’re making the most informed decisions, we recommend exploring the following related articles from the Policyholder’s Handbook:

-

Understanding Coverage Limits

Gain insights into how policy limits affect your financial protection and ensure you understand where your coverage begins and ends. -

Exclusions and Limitations

Expand your knowledge with a dedicated section on exclusions, diving further into how they shape your policy’s scope and limits. -

How Insurance Works: Premiums, Claims, and Payouts

Discover the mechanics behind insurance processes to better understand how premiums align with claims and payouts. -

Policy Endorsements and Riders

Learn how endorsements and riders can modify your policy to address coverage gaps or enhance protection. -

Tips for a Smooth Claims Experience

If an excluded event occurs or there is a dispute, explore best practices for navigating the claims process smoothly.