The Importance of Being Informed

When it comes to insurance, knowledge truly is power. Understanding the details of your insurance policy is not just a formality—it’s a critical step in safeguarding your financial future, protecting yourself and your loved ones, and ensuring peace of mind. Unfortunately, insurance policies often contain complex language and details that many people overlook. Being informed about your coverage, however, can make all the difference when you need it most.

In this guide, we explore why staying informed about your insurance policies is vital, highlighting the potential risks of not understanding your coverage and the benefits of taking an active role in your insurance choices.

Who this helps (at a glance)

- New policyholders learning the ropes

- Households with multiple policies across carriers

- Anyone who’s had a denied or delayed claim

- Caregivers and family finance managers

State specifics at a glance

- Free‑look, cancellation, and mediation rules vary by state DOI.

- Some states require specific disclosures or replacement forms.

- Your DOI provides complaint portals and consumer hotlines.

Use Paca to stay informed

- Upload policies — we summarize terms, exclusions, and key definitions.

- Build a questions list — tailored prompts for your agent/broker.

- Turn on Renewal Alerts — capture changes, endorsements, and notices.

- Centralize records — quotes, policies, EOBs, and claim communications.

Related reading

- What Is Insurance?

- Key Components of an Insurance Policy

- The Claims Process

- Understanding Coverage Limits

Why Understanding Your Insurance Coverage Matters

Getting the right insurance coverage is about more than just paying premiums or ticking a box. Here’s why every policyholder should take the time to fully comprehend their insurance:

1. Avoiding Gaps in Coverage

Insurance policies come with limitations, exclusions, and specific conditions. By thoroughly reviewing your policy, you’ll identify any gaps in coverage that could leave you unexpectedly exposed during a claim. For instance, auto insurance might not cover rental car costs, or homeowners insurance may exclude flood damage unless you add specific endorsements. Knowing these details beforehand allows you to adjust your coverage to prevent surprises.

2. Making Educated Decisions

Insurance plans often offer customizable coverage options, such as add-ons, endorsements, or higher limits for liability. Without a clear understanding of these features, you could miss out on coverage that would better suit your needs—or pay for options you don’t actually need.

3. Maximizing Benefits

Many policyholders don’t take full advantage of their insurance benefits simply because they’re unaware of them. For example, your health insurance may include free wellness programs, discounts on gym memberships, or telehealth services. Reading your policy documents ensures you know what extras are available.

4. Protecting Your Financial Health

Without proper knowledge of deductibles, premiums, and coverage limits, policyholders can inadvertently jeopardize their financial health. For instance, choosing a higher deductible might lower your premium, but could strain you financially if you have to pay out-of-pocket costs during a claim. A balanced understanding helps you find what works best for your budget and risk tolerance.

5. Ensuring Fast Claims Processing

In a stressful situation, such as after an auto accident or home damage, knowing how to file a claim will save you time and reduce frustration. Familiarity with your insurer’s claims process—including documentation requirements, deadlines, and where to file—can expedite the process significantly.

6. Staying Compliant with Legal Requirements

Some insurance coverages, like auto or workers’ compensation insurance, are legally required in most states. Failing to understand and comply with these requirements could result in fines, penalties, or even suspended licenses. Being informed ensures you remain on the right side of the law.

The Risks of Being Uninformed

Not understanding your insurance coverage can lead to some critical pitfalls, including:

- Unpaid Claims: If you don’t know which situations your policy covers, your claim could be denied due to exclusions or insufficient coverage.

- Underinsurance: Having inadequate coverage could leave you paying out-of-pocket for damages that exceed your policy limits.

- Overpaying for Coverage: Uninformed policyholders might select coverage options they don’t need or fail to shop around for competitive rates.

- Missed Deadlines: Insurance renewals, cancellations, or claims often have strict deadlines. Missing them due to a lack of awareness can have serious consequences.

Tips for Staying Informed

Taking control of your insurance knowledge doesn’t have to be overwhelming. Here’s how to stay in the loop:

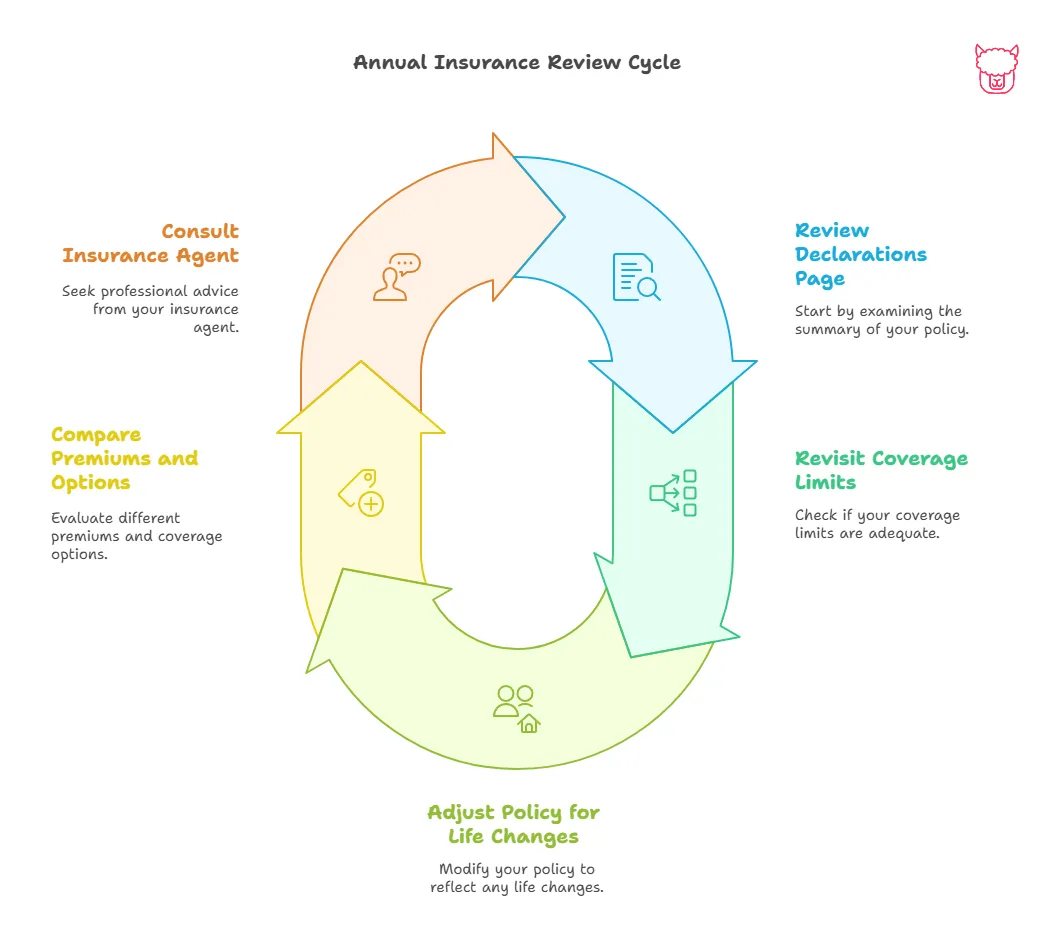

- Read Your Policy Documents: Start with the declarations page for a summary of your coverage, then dive into the insuring agreements, conditions, exclusions, and endorsements for details.

- Ask Questions: Don’t hesitate to reach out to your insurance agent or broker if something is unclear. A good agent will help break down complex terms into plain language.

- Review Annually: Life changes, and so should your insurance coverage. Review your policy at least once per year to ensure it still meets your needs.

- Stay Updated: Insurance laws and industry standards change over time. Periodically check for updates that might affect your coverage.

- Use Available Resources: Insurers like Paca Insurance provide educational materials, workshops, and online tools to help you stay informed. Take advantage of these resources to deepen your understanding.

The Benefits of Being Proactive

When you take an active role in understanding your insurance, you’re not just protecting yourself—you’re empowering yourself. Here’s what you gain:

- Confidence in managing your risks and safeguarding against unexpected events.

- The ability to make informed, strategic decisions about your coverage.

- Reduced stress and uncertainty, especially when navigating the claims process.

Conclusion

Understanding your insurance policies isn’t optional—it is essential. By staying informed, you gain control over your financial future, ensuring that you’re adequately protected when you need it. Remember, an insurance policy is more than just a piece of paper; it’s a contract that exists to give you security and peace of mind.

Take the time to read your policies, ask questions, and periodically review your coverage. Partner with Paca Insurance and trust us to provide the clarity, guidance, and support you need on your journey to being fully informed.

For any questions about your policy, contact your Paca Insurance agent today, explore our online resources, or access your account through our user-friendly platform. Knowledge is power—and with Paca Insurance, that power is in your hands.

References

- NAIC — Consumer Guides & Policyholder Tips — https://content.naic.org/consumer.htm

- Insurance Information Institute (III) — Understanding Your Policy — https://www.iii.org

- State Insurance Departments — Consumer Assistance & Complaints — https://content.naic.org/state-insurance-departments

- Healthcare.gov — Your Rights & Protections (health coverage) — https://www.healthcare.gov/rights-and-protections/