What Is Insurance?

Understanding insurance might seem complex at first, but it’s a straightforward concept once it’s broken down. At its core, insurance is a financial safety net designed to protect you from unexpected costs and losses. It’s a way of managing risk and ensuring that, when life throws you a curveball, you’re not alone in bearing the financial burden.

Who this helps (at a glance)

- First‑time buyers learning the basics

- Households comparing coverage types and costs

- Small business owners seeking foundational guidance

- Students and professionals studying risk management

State specifics at a glance

- Minimum requirements (like auto) and consumer protections vary by state.

- Free‑look periods, cancellation rules, and complaint processes differ by DOI.

- Use your state Department of Insurance for consumer guides and filings.

Use Paca to get started fast

- Upload any current policy — we extract premiums, limits, deductibles.

- Run the Savings & Coverage Scan — spot gaps and overlaps across policies.

- Turn on Renewal Alerts — avoid lapses; track review dates and changes.

- Export a starter checklist — questions to ask and terms to confirm.

- Keep everything organized — quotes, binders, endorsements, and claims.

Related reading

- The Role of Insurance in Risk Management

- Types of Insurance Policies

- Understanding Coverage Limits

- How Insurance Works: Premiums, Claims, and Payouts

- When and How to File a Claim

How Insurance Works

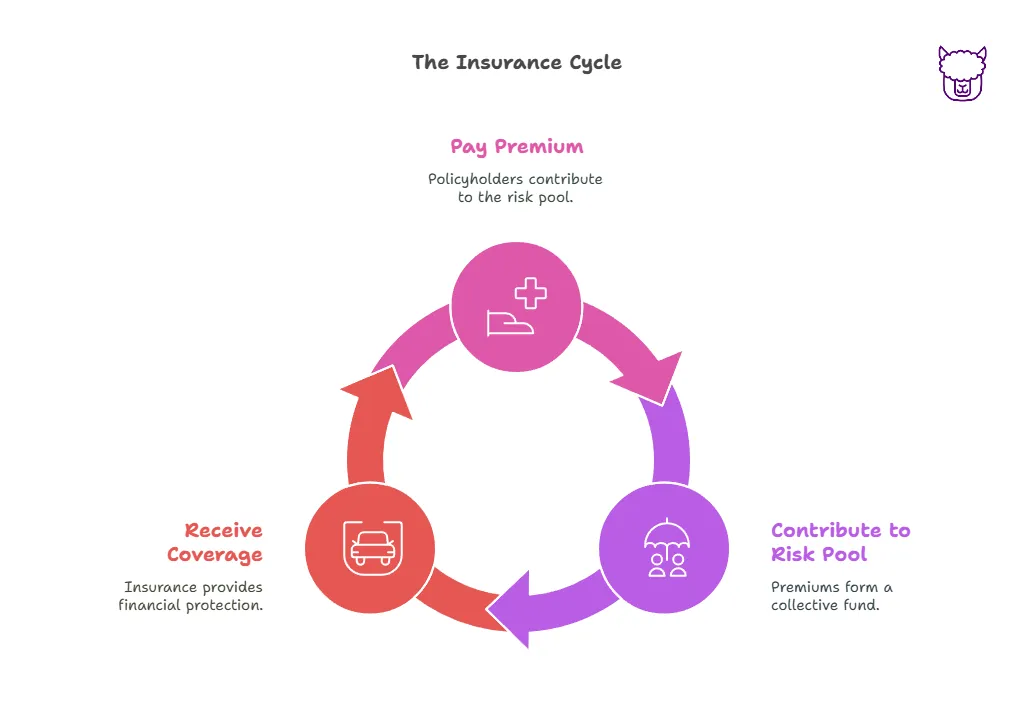

The concept of insurance is rooted in shared responsibility. Here’s how it operates:

-

You Pay a Premium

When you buy insurance, you agree to pay a certain amount of money, called a premium, to an insurance company. This payment is typically monthly, quarterly, or annually and serves as a contribution to a collective pool of funds. -

The Risk Pool

Your premium, along with payments from other policyholders, goes into this shared pool of money. The collective pool is what allows insurance companies to cover claims when individuals face losses. -

Coverage When You Need It

In exchange for paying your premium, the insurance company promises to cover specific types of losses or damages outlined in your policy — like repairing your car after an accident, paying for medical treatments, or reimbursing you for lost belongings from a house fire.

Why Do You Need Insurance?

Life is unpredictable, and unexpected events can lead to financial hardships. Insurance provides a sense of security and stability when facing unforeseen challenges. Here are a few key benefits:

- Risk Protection: Whether it’s a car accident, natural disaster, or sudden illness, insurance helps protect you financially from large, unexpected costs.

- Peace of Mind: Insurance gives you the confidence to navigate life knowing you won’t have to shoulder major financial risks on your own.

- Legal and Social Expectations: Some insurance types, like auto insurance, are legally required. Other coverages, like health insurance, are often socially expected or strongly encouraged.

Common Types of Insurance

Insurance isn’t a one-size-fits-all solution, which is why there are many types of policies, each designed to protect different aspects of your life:

- Health Insurance: Covers medical expenses, including check-ups, treatments, and surgeries.

- Auto Insurance: Protects against damages to your vehicle or others’ property in the event of an accident.

- Homeowners or Renters Insurance: Covers your home, belongings, and liability in cases like theft, disasters, or injuries to visitors.

- Life Insurance: Provides financial support to your loved ones after your passing.

- Business Insurance: Protects businesses from losses due to property damage, liability, or interruptions.

Everyday Example: How Insurance Helps

Imagine you’re driving to work one rainy morning, and you accidentally bump into another car at a stop sign. Without insurance, you might face thousands of dollars in repair costs for both your car and the other vehicle — all of which would have to come directly out of your pocket.

However, if you have an auto insurance policy, you can file a claim with your insurer. After paying your deductible (your portion of the cost), the insurance company steps in and covers the remaining damages.

Key Takeaways

- Insurance is a financial tool that helps protect you from potential risks and catastrophic financial losses.

- By paying regular premiums, you gain access to coverage that supports you when things go wrong.

- Different types of insurance address different needs — whether it’s securing your home, safeguarding your family, or protecting your health.

- Insurance provides not just financial protection, but the peace of mind to focus on other aspects of your life.

References

- National Association of Insurance Commissioners (NAIC) — Consumer Resources — https://content.naic.org/consumer.htm

- Insurance Information Institute (III) — Insurance Basics — https://www.iii.org/article/insurance-basics

- USA.gov — Insurance — https://www.usa.gov/insurance

- NAIC — State Insurance Departments — https://content.naic.org/state-insurance-departments

- Ready.gov — Financial Preparedness — https://www.ready.gov/financial-preparedness