Privacy Policies and Data Protection

In today’s digital age, privacy and data protection are critical pillars of trust between policyholders and insurance providers. When you purchase an insurance policy, you entrust your insurer with sensitive personal, financial, and health information. Understanding how this data is collected, used, stored, and protected is essential. This article explores privacy policies and data protection measures in the insurance sector and what they mean for you as a policyholder.

What Are Privacy Policies?

Privacy policies are formal documents that outline how companies, including insurance providers, handle your personal information. These policies detail:

- What data is collected: This can include your name, address, Social Security number, financial details, health records, vehicle history, and even online activity if you use an insurer’s website or app.

- Why the data is collected: Common reasons include policy underwriting, claims processing, risk assessment, fraud prevention, and marketing.

- How the data is shared: Your insurance provider may share data with third parties like reinsurers, legal counsel, or government agencies, but only for authorized purposes.

- How your data is stored and secured: The policy explains the safeguards in place to protect your information from breaches or unauthorized access.

- Your rights as a policyholder: These include the right to access your information, correct errors, opt out of marketing, and understand how your data is used.

Insurance providers are legally required to disclose their privacy practices, often through Privacy Notices that comply with laws like the Gramm-Leach-Bliley Act (GLBA) in the U.S. or the General Data Protection Regulation (GDPR) in Europe.

Why Is Data Protection Important in Insurance?

As an insurance policyholder, your data is critical to the functioning of the insurer’s operations. For example, your health data helps assess life or health coverage risks, and your driving history determines auto insurance premiums. However, this reliance on personal data also creates vulnerabilities if that data is not adequately protected.

Key risks include:

- Identity theft: Breaches can expose sensitive information like your Social Security number or driver’s license, leading to fraud.

- Unauthorized use of data: If security measures are weak, criminals may gain access to your personal information for malicious purposes.

- Loss of trust: Poor data handling can damage the reputation of your insurer and your confidence in their ability to serve you.

By implementing robust data protection measures, insurers aim to mitigate these risks and foster a sense of security and trust among policyholders.

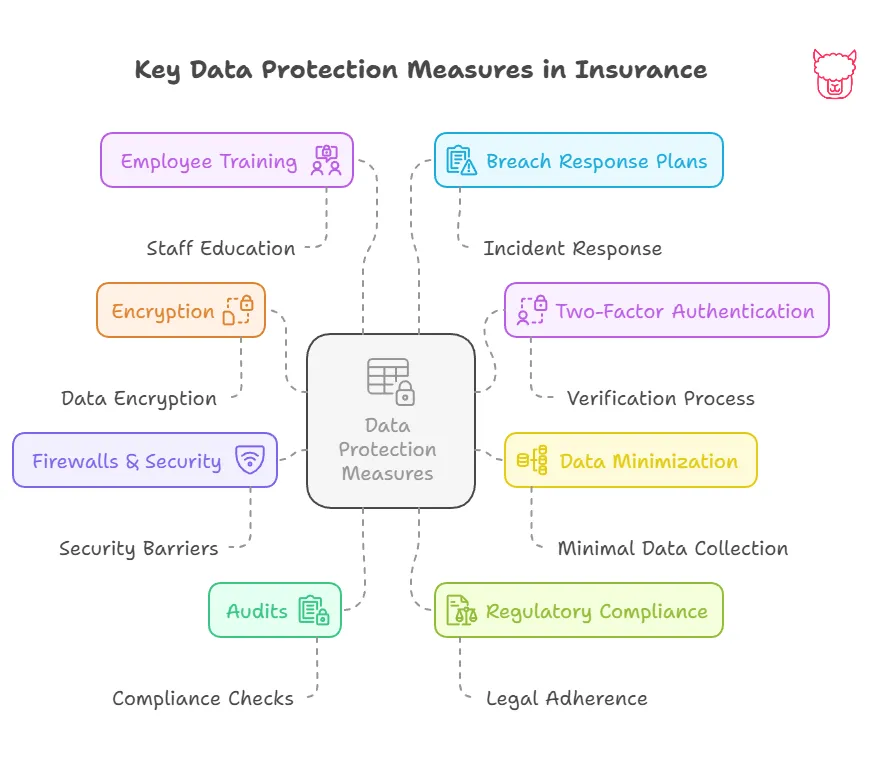

Key Data Protection Measures in the Insurance Industry

-

Encryption

Insurance companies use encryption protocols to protect sensitive data during transmission (e.g., while being sent over the internet) and at rest (when stored in databases). Encryption ensures that even if data is accessed by unauthorized parties, it cannot be read without the decryption key. -

Secure Authentication Systems

Insurers protect your data by using two-factor authentication (2FA) and secure login methods. These measures prevent unauthorized users from accessing your account, even if your password is compromised. -

Data Minimization

Companies collect only the minimal amount of data required to provide services. By reducing the volume of personal information stored, they limit exposure in the event of a breach. -

Firewalls and Network Security

Firewalls, intrusion detection systems, and other security technologies ensure that sensitive data is housed in secure networks protected from cyberattacks. -

Regular Audits

Internal and third-party audits help insurers identify vulnerabilities in their systems and implement timely fixes to prevent breaches. -

Compliance with Regulations

Insurance providers must comply with national and international privacy laws such as:- HIPAA (Health Insurance Portability and Accountability Act) for protecting health data.

- GLBA for financial data privacy.

- GDPR for handling data of European Union residents.

-

Employee Training

Employees are trained on proper data handling practices to reduce human errors that can lead to breaches. -

Data Breach Response Plans

In the event of a data breach, insurers are required by law in many jurisdictions to notify affected policyholders promptly, assess potential damages, and offer remedies such as credit monitoring.

How Paca Insurance Protects Your Privacy

At Paca Insurance, we value your privacy and are committed to protecting your data through:

- Transparent privacy policies that clearly explain how your information is collected, used, and shared.

- Advanced cybersecurity systems to safeguard your data.

- Strict compliance with regulatory standards.

- Dedicated customer service to address questions and concerns about your personal information.

Our ongoing investment in data protection technologies ensures that your information remains private and secure.

Your Role in Managing Privacy

While your insurer takes significant steps to protect your data, you also play an important role. Here are some ways you can enhance your data security:

- Use strong, unique passwords for online accounts and enable two-factor authentication.

- Regularly review the privacy settings in your insurer’s online platform or mobile app.

- Be cautious when sharing sensitive information online or over the phone, especially if you did not initiate the interaction.

- Notify your insurer immediately if you suspect unauthorized access to your account.

Conclusion

Privacy policies and data protection are cornerstones of the insurance industry, ensuring that your sensitive information is handled with care and safeguarded against breaches. By understanding how your data is collected, used, and protected—and by taking appropriate precautions yourself—you can confidently manage your insurance policy while protecting your privacy.

Your trust is our top priority at Paca Insurance. If you have any questions about our privacy practices or need assistance managing your data, feel free to contact us 24/7 through our Ask Paca service.

References

- U.S. Federal Trade Commission (FTC): Protecting Personal Information

- National Association of Insurance Commissioners (NAIC): Consumer Privacy Protections

- GDPR Compliance Guidelines: EU GDPR Info

By being informed and proactive, you can navigate the complexities of privacy with confidence and peace of mind.

Next Steps

To further expand your understanding of privacy, data protection, and related topics, here are some recommended articles from the Policyholder’s Handbook:

-

Your Rights as a Policyholder

Discover in-depth information about your rights and protections as a policyholder, including how insurers are legally required to handle your data responsibly. -

How Insurance Works: Premiums, Claims, and Payouts

For a foundational understanding of how data impacts mechanics like claims processing and risk calculation, explore this article on the inner workings of the insurance industry. -

Regulatory Bodies and Compliance

Learn about the regulations that govern the insurance industry and how compliance with these rules ensures your data is safeguarded. -

Tips for a Smooth Claims Experience

Filing an insurance claim involves sharing sensitive information. This guide will provide you with best practices to ensure a stress-free and secure claims process. -

Exclusions and How They Impact Coverage

Delve into the subtleties of how policy exclusions are defined, which can sometimes intersect with privacy and data considerations.